Graduate Student Payments FAQ

Graduate Student Payments FAQ

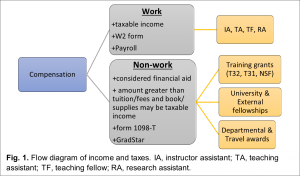

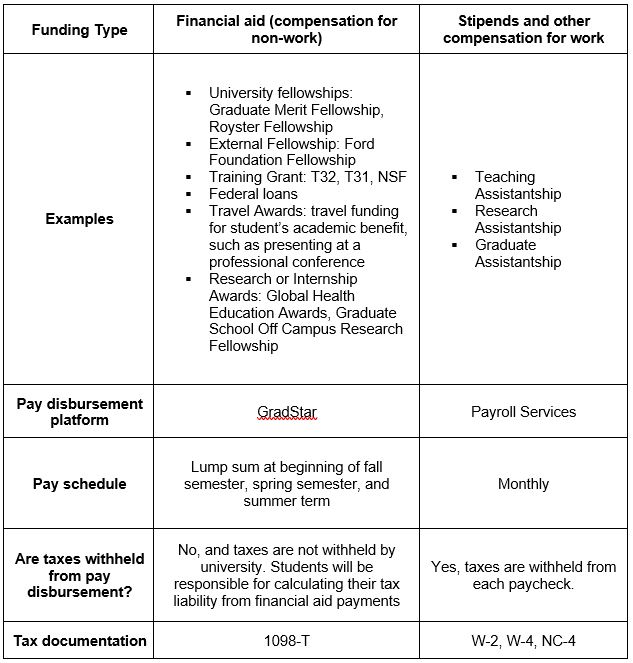

How are different sources of funding, including assistantships, grants, fellowships and awards categorized by the graduate school? How are these funds disbursed? The university uses a set of technical terms to categorize different funding sources. The way your funding and compensation are defined determines the way they are disbursed to you throughout the year and taxed (see Fig.1). Distinguishing between financial and compensation for work is key to understanding how and when you will be paid, as well as your tax liability (see Fig.2). Below is a guide: Fig. 2. Guide to understanding funding types and payments

Stipends or other sources of compensation can include Teaching Assistantships, Research Assistantships, or Graduate Assistantships. These sources of funding compensate you for work or service and are considered taxable income.Financial aid is an umbrella term that broadly includes any source of funding that is for your academic benefit. University fellowships, external fellowships, training grants, travel awards, and federal loans are considered financial aid (note: this is not an exhaustive list of financial aid types). The key is that financial aid is financial support that is not compensating service or work to the university or your department.

Each student’s situation is different, and funding sources can change from year to year. In general, all payments provided to students are considered financial aid unless it is compensation for work or service.

Who will be affected by the policy change starting in August 2021? If you are compensated for work or service, you will continue to receive monthly payments and taxes will be withheld by payroll services. Students who are funded by a training grant, that is not compensation for work or service, will be paid once per semester. Payments are reported in GradStar by your department. Payments are made in a lump sum at the beginning of each semester. Please note, the university does not withhold taxes from financial aid. Students receiving payments per semester should consult with a qualified tax advisor about tax liability. Students receiving a training grant in addition to other forms of financial aid, particularly federal loans, may have their loan eligibility adjusted to remain compliant with federal financial aid guidelines.

How will this affect taxes? As tax liability is based on many factors for each individual, the University cannot speak definitively on how this will affect each student. In general, financial aid (as listed in Fig. 2) may be taxable if it exceeds your qualified tuition and related expenses. Qualified tuition and related expenses are defined by the Internal Revenue Service (IRS) as “tuition and fees required for enrollment or attendance at the educational institution or for books, supplies and equipment required for courses of instruction at the institution and required of all students in your course of instruction.” If the sum of your financial aid exceeds your qualified tuition and related expenses, part of your award may be taxable. You should direct questions concerning the taxability of financial aid to the IRS or a qualified tax consultant. Compensation paid through Payroll Services (see Fig. 2) will have applicable Federal and state taxes withheld based upon the individual’s tax forms (i.e., W-4 and NC-4) and the defined tax withholding tables. Questions about FICA taxes: For students enrolled at least half-time for the respective period (e.g., academic semesters or summer session) in which they are being paid for work or service, FICA taxes are not withheld due to the Student FICA exception defined by the IRS. The May 2021 announcement about changes to graduate funding disbursement schedules does not change how and when FICA taxes are withheld. For periods where FICA taxes are not withheld, wages are not recorded with the Social Security Administration. For more information on tax liability for graduate students, see the IRS website. How will this affect my ability to finance large purchases and secure loans or a mortgage? Students who receive the majority of their funding from financial aid should ask their department’s Student Services Manager for official documentation of their financial aid amount and receipt to secure loans and mortgages. Student Services Managers have the authority to provide official documentation upon request. Who should I turn to with questions about my funding? Reach out to your department’s Student Services Manager. Additional information about your funding sources can be provided by Beverly Wyrick, Director of Administration and Finance (beverly_wyrick@unc.edu). Questions about how your funding will impact financial aid (e.g., federal loans) offered by the Office Of Scholarships and Student Aid (OSSA) should be direct to OSSA at ssa_graduate@unc.edu Why is this policy change happening? This policy change is required to ensure the University is compliant with federal and state regulations. Federal financial aid regulations state that any educational benefits paid to students because of enrollment in a postsecondary education institution, or to cover postsecondary education expenses is considered financial aid unless it’s compensation for work performed. Additionally, for students receiving federal or state aid through the Office of Scholarships and Student Aid (OSSA) the total aid, in combination with any other financial assistance received (e.g., see Financial Aid in Fig. 2), cannot exceed the Cost of Attendance. With the goal of ensuring the University is compliant with federal and state regulations, the change to student payments was necessary. Do I need to fill out an additional direct deposit form for GradStar? Financial aid recipients (see Fig. 2) should set up direct deposit with the University through ConnectCarolina – Student Financials. To do this, login to the Student Center through Self Service in ConnectCarolina. In the Student Financials section, click on Pay Bills/Manage Student Finances. Then click on Electronic Refunds and then Set Up Account where you will be asked to enter your bank account information. Pop-up blockers must be disabled to allow the system to display pages. Instructions can be found here: https://cashier.unc.edu/wp-content/uploads/sites/259/2016/05/setting-up-an-electronic-refund-account-for-student-account-refunds.pdf Is anything that is not considered money in exchange for work considered financial aid? What dictates something as financial aid? Any educational benefits paid to students because of enrollment in a postsecondary education institution, or to cover postsecondary education expenses is considered financial aid unless it’s compensation for work performed. This would include monetary awards as well as the “value” of any tangible awards or prizes (i.e. computer, tablet, gift cards, etc.) Are there rules about what we are allowed to spend our stipend on if it is financial aid? The Office of Scholarships and Student Aid does not monitor how students spend their stipends. Can the GradStar payments be disbursed monthly instead of by semester? If not, why? No. Payments made through GradStar are disbursed per semester. GradStar is aligned to disburse payments through the Office of Scholarships & Student Aid’s (OSSA) disbursement system. All financial aid disbursed through OSSA is on a per semester basis.